We lately began a sequence known as “Penny Inventory of the Day”. These concepts are geared in the direction of merchants with a particularly excessive threat urge for food.

Our Penny Inventory of the Day is chosen by screening for shares underneath $5 after which making use of technical evaluation on the shortlisted set of penny shares displaying uncommon quantity. When making these trades, please be sure that to pay vigilant consideration to pricing strikes and have a strict cease loss in place to keep away from important losses.

Right this moment’s penny inventory choose is the power firm, Baytex Power Corp. (NYSE: BTE).

Baytex Power Corp. engages within the acquisition, improvement, and manufacturing of crude oil and pure gasoline within the Western Canadian Sedimentary Basin and within the Eagle Ford, the USA. The corporate affords gentle oil and condensate, heavy oil, pure gasoline liquids, and pure gasoline. It additionally holds curiosity within the Eagle Ford property in Texas; Viking and Lloydminster properties in Alberta and Saskatchewan; and Peace River and Duvernay properties in Alberta.

Web site:

Newest 10-k report: /content/uploads/2024/03/2023-Annual-Report.pdf

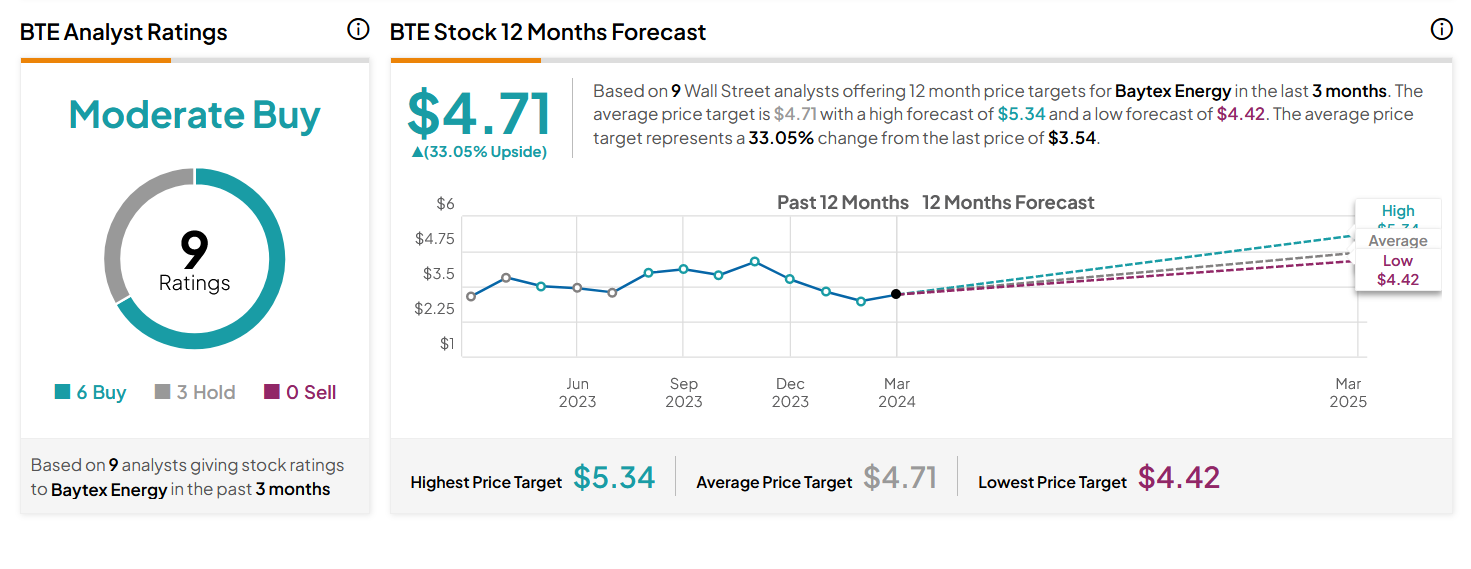

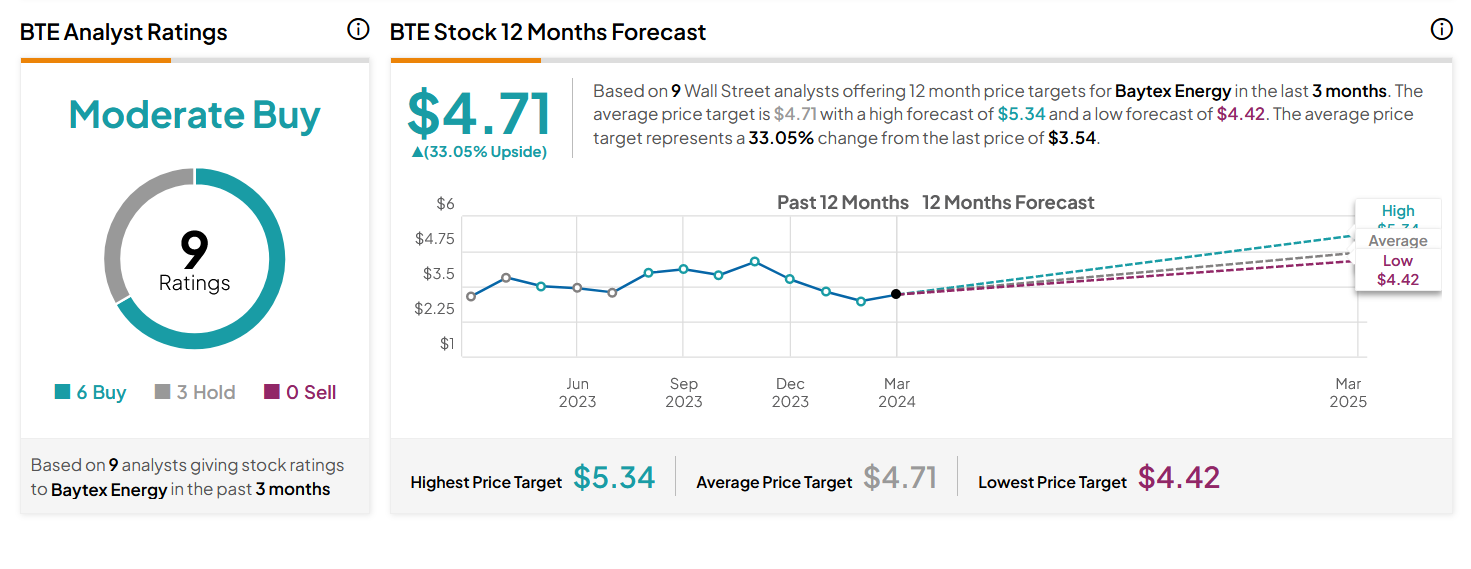

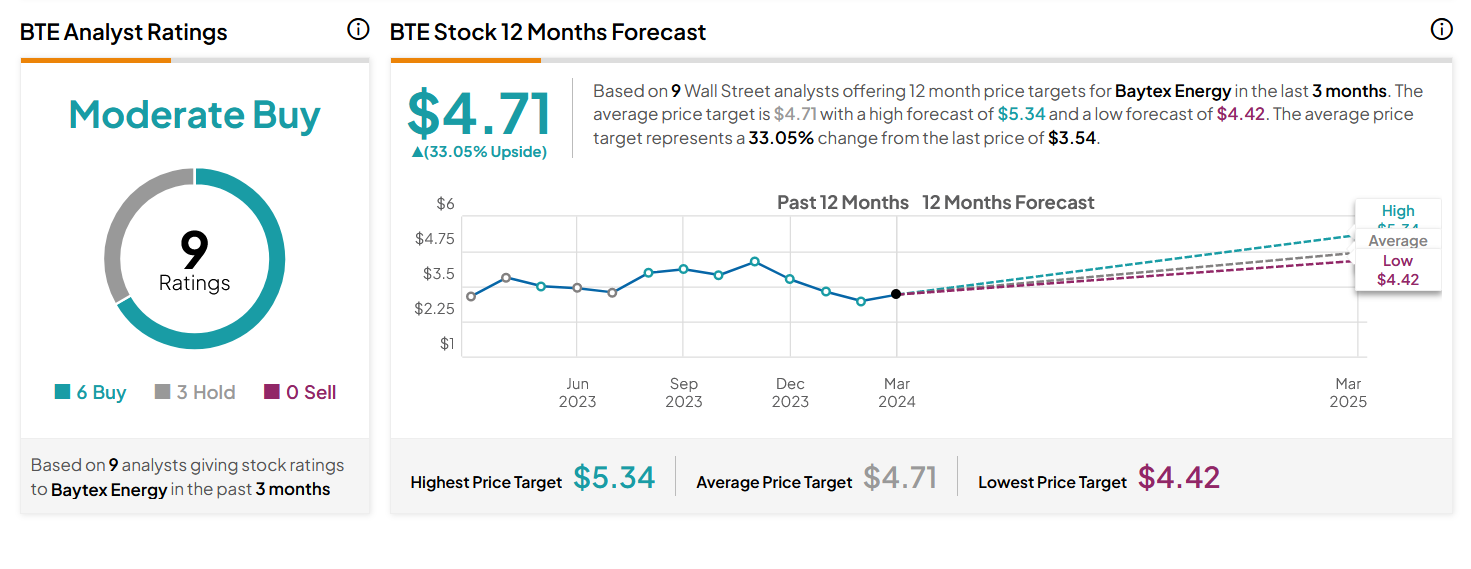

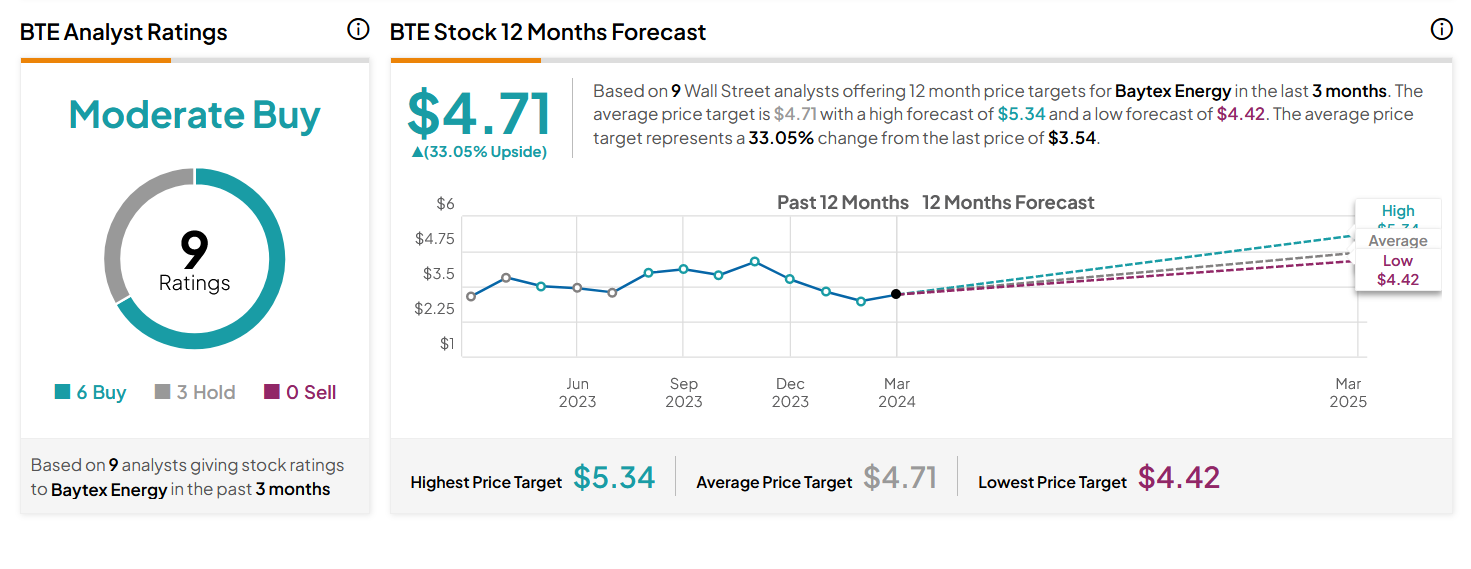

Analyst Consensus: As per TipRanks Analytics, primarily based on 9 Wall Avenue analysts providing 12-month worth targets for BTE within the final 3 months, the inventory has a median worth goal of $4.71, which is almost 33% upside from present ranges.

Analysts | Supply: TipRanks.com

On analyzing the corporate’s inventory charts, there appear to be a number of bullish indications…

#1 Downtrend Channel Breakout: The day by day chart exhibits that the inventory has damaged out of a downtrend channel, which is proven as orange colour traces. This can be a doable bullish indication.

BTE – Every day Chart

#2 Bullish ADX and DI: The ADX indicator exhibits bullishness because the +DI line is above the -DI line, and the ADX line is at present shifting increased from under the +DI and -DI traces.

#3 Value above MA: The inventory is at present above its 50-day SMA, indicating that the bulls have at present gained management.

#4 MACD above Sign Line: Within the day by day chart, the MACD (gentle blue colour) is at present above the MACD sign line (orange colour). This means a doable bullish setup.

#5 Above Assist Space: The weekly chart exhibits that the inventory is at present buying and selling above a assist space, which is marked as a pink colour dotted line. This seems to be like space for the inventory to maneuver increased.

BTE – Weekly Chart

#6 Bullish Stoch: The %Ok line is above the %D line of the stochastic within the weekly chart, indicating doable bullishness.

#7 MACD above Sign Line: Within the weekly chart as nicely, the MACD (gentle blue colour) is at present above the MACD sign line (orange colour). This means a doable bullish setup.

Really useful Commerce (primarily based on the charts)

Purchase Ranges: If you wish to get in on this commerce, the best purchase degree for BTE is above the value of $3.60.

Goal Costs: Our first goal is $4.50. If it closes above that degree, the second goal worth is $5.20.

Cease Loss: To restrict threat, place a cease loss at $3.10. Be aware that the cease loss is on a closing foundation.

Our goal potential upside is 25% to 44%.

For a threat of $0.50, our first goal reward is $0.90, and the second goal reward is $1.60. This can be a practically 1:2 and 1:3 risk-reward commerce.

In different phrases, this commerce affords 2x to 3x extra potential upside than draw back.

As you possibly can see, as we speak’s featured penny inventory affords huge upside potential… nevertheless it additionally comes with a lot of dangers and pink flags. As at all times, when coping with penny shares, we advise warning earlier than getting into into such high-risk ventures. Keep in mind to suppose earlier than you commerce… perceive the dangers… and for those who determine to commerce, stick with your stop-losses!

Comfortable Buying and selling!

Trades of the Day Analysis Crew

READ BEFORE TRADING PENNY STOCKS: The attract of penny shares lies of their potential to ship huge good points in a brief time frame. Nonetheless, in change for that chance, most penny shares carry great threat. They are often extraordinarily risky and are vulnerable to “pump and dump” schemes and fraud.

Not like common shares, the monetary situation of most penny inventory corporations could be extraordinarily tough to research, as nearly all of such shares are traded on over-the-counter (OTC) exchanges, that are usually much less clear and fewer regulated than the most important exchanges. Actually, within the penny inventory area, it’s usually simpler to identify warning indicators and pink flags than it’s to determine a sound funding. However, we do our greatest to determine short-term commerce alternatives on this thrilling area as a result of we all know a few of our readers are on the lookout for high-risk, high-reward concepts. We simply urge you to be sure you totally perceive the dangers earlier than making any of those trades.

1 New Trade. Each Week. 80% Win Rate Guaranteed.

[sponsor]

1 New Commerce. Every Week. 80% Win Fee Assured.

Supply: Trades of the Day

Our Penny Inventory of the Day is chosen by screening for shares underneath $5 after which making use of technical evaluation on the shortlisted set of penny shares displaying uncommon quantity. When making these trades, please be sure that to pay vigilant consideration to pricing strikes and have a strict cease loss in place to keep away from important losses.

Penny Inventory of the Day: Baytex Power Corp. (NYSE: BTE)

Right this moment’s penny inventory choose is the power firm, Baytex Power Corp. (NYSE: BTE).

Baytex Power Corp. engages within the acquisition, improvement, and manufacturing of crude oil and pure gasoline within the Western Canadian Sedimentary Basin and within the Eagle Ford, the USA. The corporate affords gentle oil and condensate, heavy oil, pure gasoline liquids, and pure gasoline. It additionally holds curiosity within the Eagle Ford property in Texas; Viking and Lloydminster properties in Alberta and Saskatchewan; and Peace River and Duvernay properties in Alberta.

Web site:

Newest 10-k report: /content/uploads/2024/03/2023-Annual-Report.pdf

Analyst Consensus: As per TipRanks Analytics, primarily based on 9 Wall Avenue analysts providing 12-month worth targets for BTE within the final 3 months, the inventory has a median worth goal of $4.71, which is almost 33% upside from present ranges.

Analysts | Supply: TipRanks.com

Potential Catalysts / Causes for the Hype:

- The corporate is projected to generate US$528 million in 2024 free money circulate at present strip costs. That is round US$138 million greater than Baytex’s estimates from December 2023, because it advantages from improved oil strip costs.

- Optimistic sentiment associated to the Trans mountain pipeline opening and the primary order from China for 550,000 barrels. China’s Sinochem Group bought one of many first crude cargoes shipped by way of a brand new pipeline in Canada, which is designed to maneuver oil from landlocked Alberta to the Pacific Coast for export.

- The advance within the assumed odds of BTE profitable its tax dispute with the Canada Income Company.

- Rumors of a takeover.

On analyzing the corporate’s inventory charts, there appear to be a number of bullish indications…

Bullish Indications

#1 Downtrend Channel Breakout: The day by day chart exhibits that the inventory has damaged out of a downtrend channel, which is proven as orange colour traces. This can be a doable bullish indication.

BTE – Every day Chart

#2 Bullish ADX and DI: The ADX indicator exhibits bullishness because the +DI line is above the -DI line, and the ADX line is at present shifting increased from under the +DI and -DI traces.

#3 Value above MA: The inventory is at present above its 50-day SMA, indicating that the bulls have at present gained management.

#4 MACD above Sign Line: Within the day by day chart, the MACD (gentle blue colour) is at present above the MACD sign line (orange colour). This means a doable bullish setup.

#5 Above Assist Space: The weekly chart exhibits that the inventory is at present buying and selling above a assist space, which is marked as a pink colour dotted line. This seems to be like space for the inventory to maneuver increased.

BTE – Weekly Chart

#6 Bullish Stoch: The %Ok line is above the %D line of the stochastic within the weekly chart, indicating doable bullishness.

#7 MACD above Sign Line: Within the weekly chart as nicely, the MACD (gentle blue colour) is at present above the MACD sign line (orange colour). This means a doable bullish setup.

Really useful Commerce (primarily based on the charts)

Purchase Ranges: If you wish to get in on this commerce, the best purchase degree for BTE is above the value of $3.60.

Goal Costs: Our first goal is $4.50. If it closes above that degree, the second goal worth is $5.20.

Cease Loss: To restrict threat, place a cease loss at $3.10. Be aware that the cease loss is on a closing foundation.

Our goal potential upside is 25% to 44%.

For a threat of $0.50, our first goal reward is $0.90, and the second goal reward is $1.60. This can be a practically 1:2 and 1:3 risk-reward commerce.

In different phrases, this commerce affords 2x to 3x extra potential upside than draw back.

Potential Dangers / Crimson Flags:

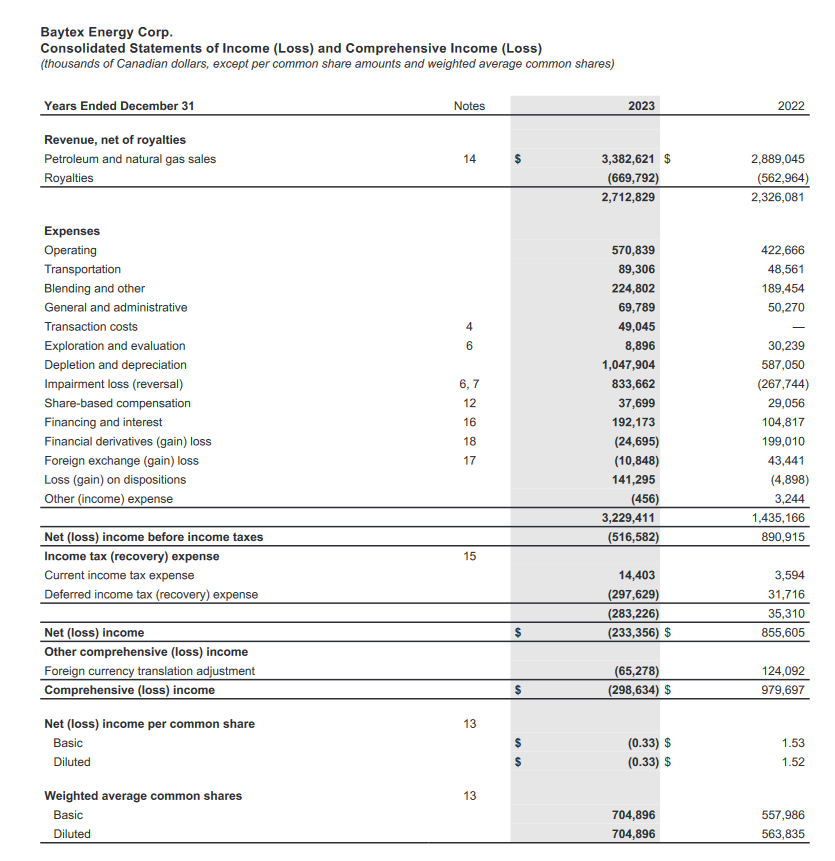

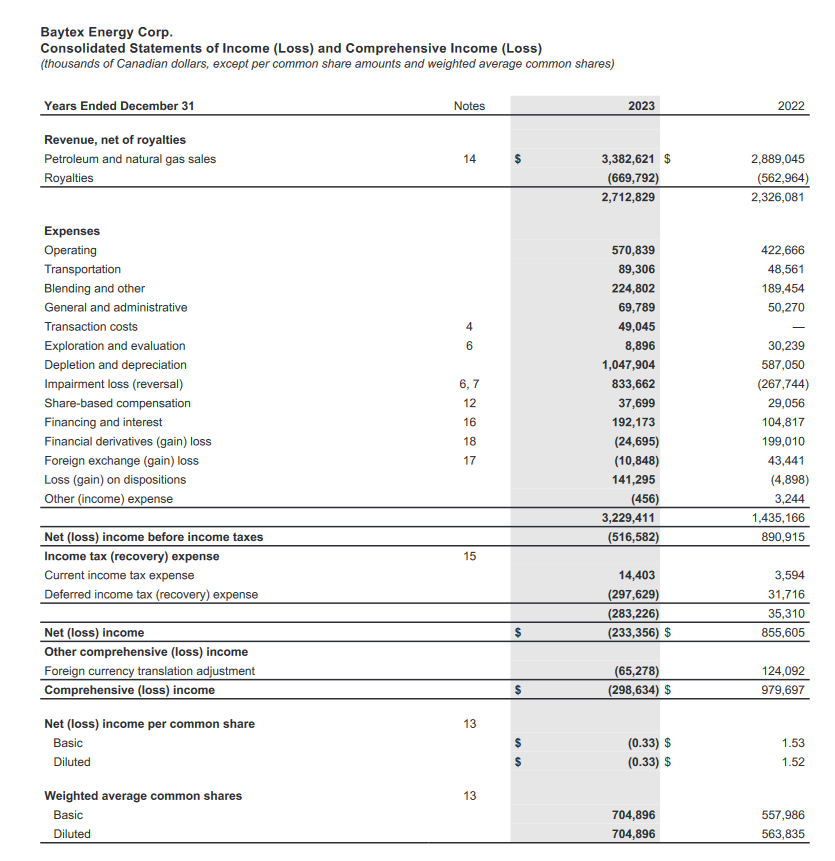

- The corporate has a historical past of web losses. BTE reported a web lack of $233.4 million for 2023.

BTE – Consolidated Statements of Operations

- The corporate’s monetary situation is considerably depending on, and extremely delicate to, the prevailing costs of crude oil and pure gasoline. As well as, a transition away from the usage of petroleum merchandise, which can embrace conservation measures, various gasoline necessities, rising shopper demand for alternate options to grease and pure gasoline and technological advances in gasoline financial system and renewable power, might cut back demand for oil and pure gasoline.

- The corporate’s C$3.4 billion (US$2.5 billion) Ranger deal had resulted in BTE assuming the debt load of Ranger Oil, thereby practically tripling its web debt steadiness. BTE’s new capital allocation plan requires allocating 50% of free money circulate to dividends and share repurchases which additionally reduces the tempo of debt discount.

- The corporate needed to hedge 40% of its oil publicity for 12 months to safe financing on acceptable phrases, making BTE unable to profit from the excessive oil costs.

As you possibly can see, as we speak’s featured penny inventory affords huge upside potential… nevertheless it additionally comes with a lot of dangers and pink flags. As at all times, when coping with penny shares, we advise warning earlier than getting into into such high-risk ventures. Keep in mind to suppose earlier than you commerce… perceive the dangers… and for those who determine to commerce, stick with your stop-losses!

Comfortable Buying and selling!

Trades of the Day Analysis Crew

READ BEFORE TRADING PENNY STOCKS: The attract of penny shares lies of their potential to ship huge good points in a brief time frame. Nonetheless, in change for that chance, most penny shares carry great threat. They are often extraordinarily risky and are vulnerable to “pump and dump” schemes and fraud.

Not like common shares, the monetary situation of most penny inventory corporations could be extraordinarily tough to research, as nearly all of such shares are traded on over-the-counter (OTC) exchanges, that are usually much less clear and fewer regulated than the most important exchanges. Actually, within the penny inventory area, it’s usually simpler to identify warning indicators and pink flags than it’s to determine a sound funding. However, we do our greatest to determine short-term commerce alternatives on this thrilling area as a result of we all know a few of our readers are on the lookout for high-risk, high-reward concepts. We simply urge you to be sure you totally perceive the dangers earlier than making any of those trades.

1 New Trade. Each Week. 80% Win Rate Guaranteed.

[sponsor]

1 New Commerce. Every Week. 80% Win Fee Assured.

Supply: Trades of the Day